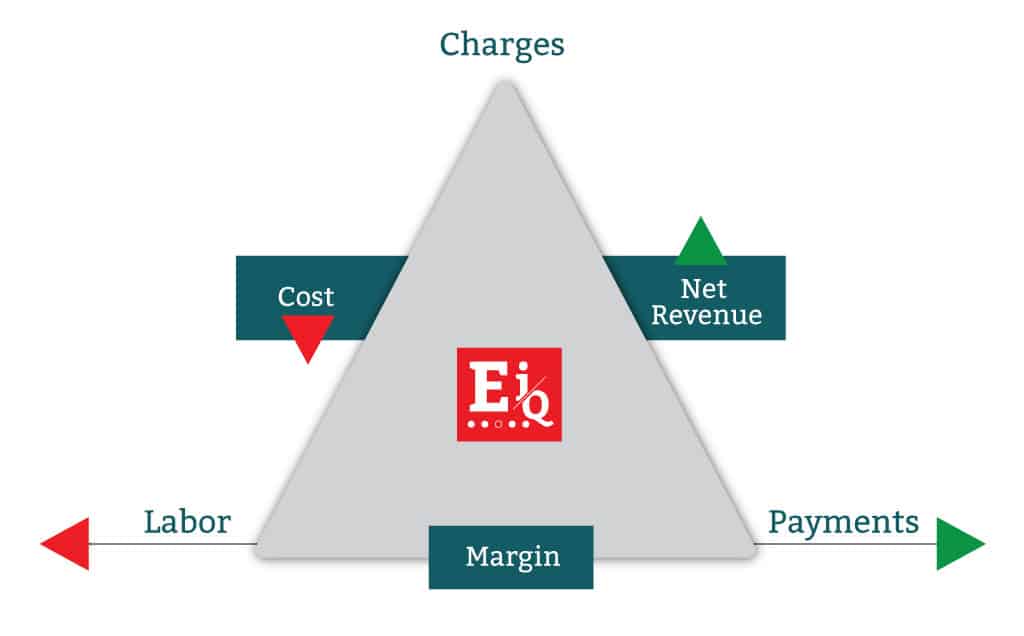

Real-time technology, process, & people changes are necessary to maximize net collection rate

Practice management systems are not capable of producing net collection rate in real time. In regards to the net charge and the payments that you are actually collecting against the net charge, if you’re not above 97% benchmark, you have a problem. You need to understand why you have non-contractual adjustments and what process, people, or technology changes will help to grab those extra percentage points on your net collection rate. In many cases, all three need to be adjusted.

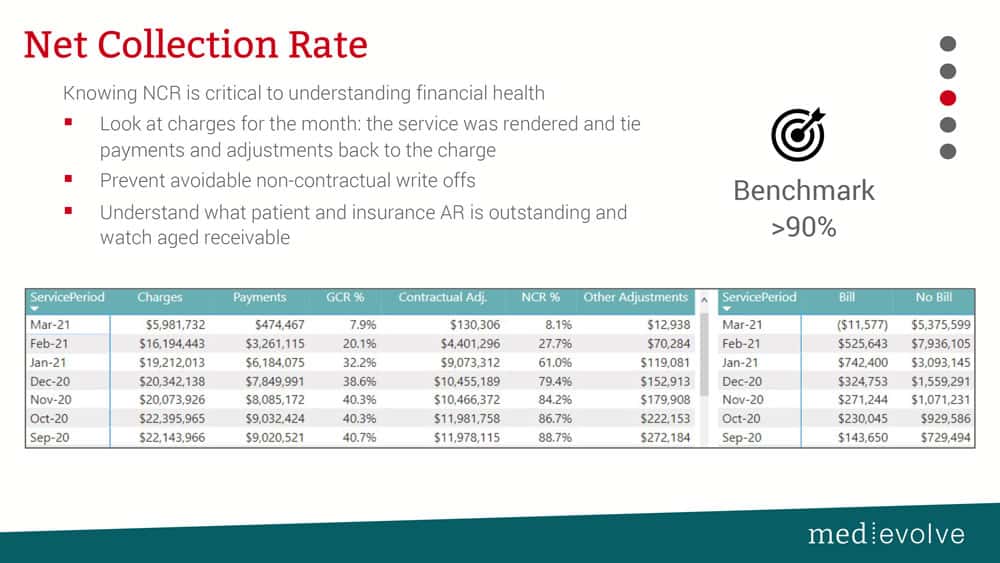

You need to determine why your open net collection rate is less than 90%

Let’s look at NCR in two ways. First, analyzing zero balance net collection rate is looking at your zero balance claims and saying, How well did we do? Then, there is the open net collection rate that tells you how well you are collecting on your account receivable. For example, if you lag it 60 days, and then analyze current collections 60 days from the service or file date (however your organization prefers to evaluate it), you should have collected at least 90% of the net charge.

Why are most organizations below 90%?

The first reason is unpaid self-pay debt that probably should have been collected prior to service as well as historical self-pay debt before you see the patient again. The second reason is denial issues. 52% of the denials that we see in our RCM services organization come from front office breakdowns. As a result, that creates more work in the back office, like A/R, which in turn also impacts your open net collection rate.

Two segments of net collection rate that you need to be able to review in real time: what’s due by the patient and what’s due by insurance. You will start to see trends in the receivables in order to strategize and then collect from insurance as well as patients. Next, analyze your net collection rate from a service date, not a post date. For example, if I look at November of 2021, I need to know how many payments have I collected against the charges that were generated by services in that month. Then, I need to know what’s still out there to be collected from the patient and the insurance.

When using dynamic, intelligent reporting like we do in our Effective Intelligence suite, I am able see net collection rates in the following ways: open NCR, zero balance NCR, and NCR by payer, provider and location either individually or all at once. You have to have dynamic ways in real time to slice up the data to try to figure out where that remaining money has gone, and if you are not collecting that 97% or better, determine why.

52% of the denials that we see in our RCM services organization come from front office breakdowns. As a result, that creates more work in the back office, like A/R, which in turn also impacts your open net collection rate.

How are non-contractual adjustments affecting your NCR?

Another key data point you need to be able to see in real time is your non-contractual adjustments compared to the net collection rate (see screen shot above), especially on the zero balance. You need to understand the adjustments that are being taken against the charge like avoidable write offs, bad debt write offs, charity allowance, and administrative write offs – anything that is a non-contractual adjustment. This will also tell you where you may need to focus to improve your net collection rate. Make sure you understand how many charges were written off at 100% percent. If you begin to see large amounts of visits where the entire charge is being written off to non-contractual, you need to be able to isolate those quickly and figure out why.

This all comes down to the transaction codes mapping and the accuracy in which your payment teams are posting those. I’ve talked with many potential clients who write off denials to contractual. You can’t do that. Contractual is contractual – period. Everything else needs to be segmented into the appropriate bucket. Also, I would be very specific on the adjustment reason code, because you need to be able to understand if it’s no-authorization denial, a timely filing denial, medical necessity, coding, charge entry, etc. Make sure that your transaction codes are set up accurately and they are being used correctly by the staff that are posting them.

About Matt Seefeld

Matt Seefeld, Chief Executive Officer at MedEvolve, brings over 24 years of management consulting experience in the healthcare industry. He has extensive expertise in the assessment, design and implementation of process improvement programs and technology development across the entire revenue cycle. Matt began his career with Stockamp & Associates, Inc. and worked for both PricewaterhouseCoopers LLP and Deloitte Consulting LLP in their healthcare and life sciences practice lines. In 2007, he developed a business intelligence solution and founded Interpoint Partners, LLC, where he served as Chairman and Chief Executive Officer. In 2011, he sold his business to Streamline Health Solutions where he then served as Chief Strategist of Revenue Cycle followed by Senior Vice President of Solutions Strategy until 2014. Matt ran global sales for NantHealth and provided consulting services for healthcare technology and service businesses nationwide, prior to joining MedEvolve full-time.

Matt Seefeld, Chief Executive Officer at MedEvolve, brings over 24 years of management consulting experience in the healthcare industry. He has extensive expertise in the assessment, design and implementation of process improvement programs and technology development across the entire revenue cycle. Matt began his career with Stockamp & Associates, Inc. and worked for both PricewaterhouseCoopers LLP and Deloitte Consulting LLP in their healthcare and life sciences practice lines. In 2007, he developed a business intelligence solution and founded Interpoint Partners, LLC, where he served as Chairman and Chief Executive Officer. In 2011, he sold his business to Streamline Health Solutions where he then served as Chief Strategist of Revenue Cycle followed by Senior Vice President of Solutions Strategy until 2014. Matt ran global sales for NantHealth and provided consulting services for healthcare technology and service businesses nationwide, prior to joining MedEvolve full-time.