Reduce your dependence on labor to combat staffing challenges

73% of medical practices rank staffing as their biggest challenges and 76% are making operational changes due to shortages.

MGMA 2021 Survey

The need to improve the effectiveness and quality of revenue cycle processes is paramount for today’s healthcare organizations. Executives are facing declining profit margins, growing reimbursement challenges associated with patient collections and another rapidly evolving issue: staffing shortages. More than ever, provider organizations need to make the most of available staff resources. Executives also need transparency into workflows to ensure staff–especially remote staff–are not just productive, but also effective in the use of their time. Understanding the “why” behind staff effectiveness can ultimately be the catalyst that ensures a billing team is improving the bottom line as opposed to leaving money on the table.

A survey of 411 healthcare finance executives pointed to significant staffing shortages in the realm of revenue cycle workers, with billing specialists topping the list.

AKASA 2021 Survey

Remote work options have become a key strategy for recruitment and retention of staff

Research shows that employees want more flexibility. According to a 2021 Forbes report, nearly 100% of workers said they would like to have some level of remote work and believe they are equally or more productive working outside of the office. Drawing on the power of automation can significantly reduce administrative burden and manual processes. Often, the right strategy can reduce staffing needs by as much as 30%. Workflow automation, in particular, is a game changer in this arena and can not only improve productivity, but also the effectiveness of limited resources.

Moving from Basic Intelligence to Effective Intelligence

Sizeable shifts in reimbursement models are exacerbating the shortfalls of reactive revenue cycle processes—including claims issues, denials management and rapidly growing bad debt associated with patient responsible balances.

As these changes collide with ongoing staff shortages, healthcare executives must become more “effective” in their use of revenue cycle resources. This requires that they derive deeper insights from structured data and move from decisions based on basic intelligence to effective intelligence—a model that enables users to execute tasks more effectively and measure the financial outcomes of work effort.

The best strategies offer real-time visibility into a provider organization’s effective intelligence quotient, revealing the bottom-line effectiveness of each staff member and providing answers to questions such as: “What is my zero touch resolution rate?” and “Who are my most effective team members?” and “What is my net collection rate (NCR)?”

Extracting the Greatest Value from Limited Staff Resources

Effective intelligence is the cornerstone of a lean and efficient revenue cycle. The right technology framework can significantly reduce dependence on labor and improve staff effectiveness.

Workflow automation solutions help:

- Providers reduce overhead costs

- Staff work faster and more accurately

- Managers monitor staff (remote and onsite) productivity and effectiveness

Additionally, workflow automation is the key to improving EiQ. These solutions automate manual tasks, speeding daily work and improving accuracy. Staff are directed to tasks that have potential to produce the most ROI—an important component to improving effectiveness as 80% to 90% of claims—do not need attention on a daily basis. When billing staff are directed to right tasks, it expedites reimbursement and improves cash flow.

Combined with virtual communication tools and task management, workflow automation also helps provider organizations mobilize virtual workforces and manage financial outcomes. Without visibility into daily activity, financial executives have no insight into the productiveness or effectiveness of their staff, nor do they have the ability to hold staff accountable.

Analytics is also an important part of the right technology strategy to support effective intelligence. Yet, while many providers recognize the need to garner insights from data, they often miss the boat when it comes to the infrastructure needed to support an optimal revenue cycle. In other words, analytics for the sake of analytics will not deliver.

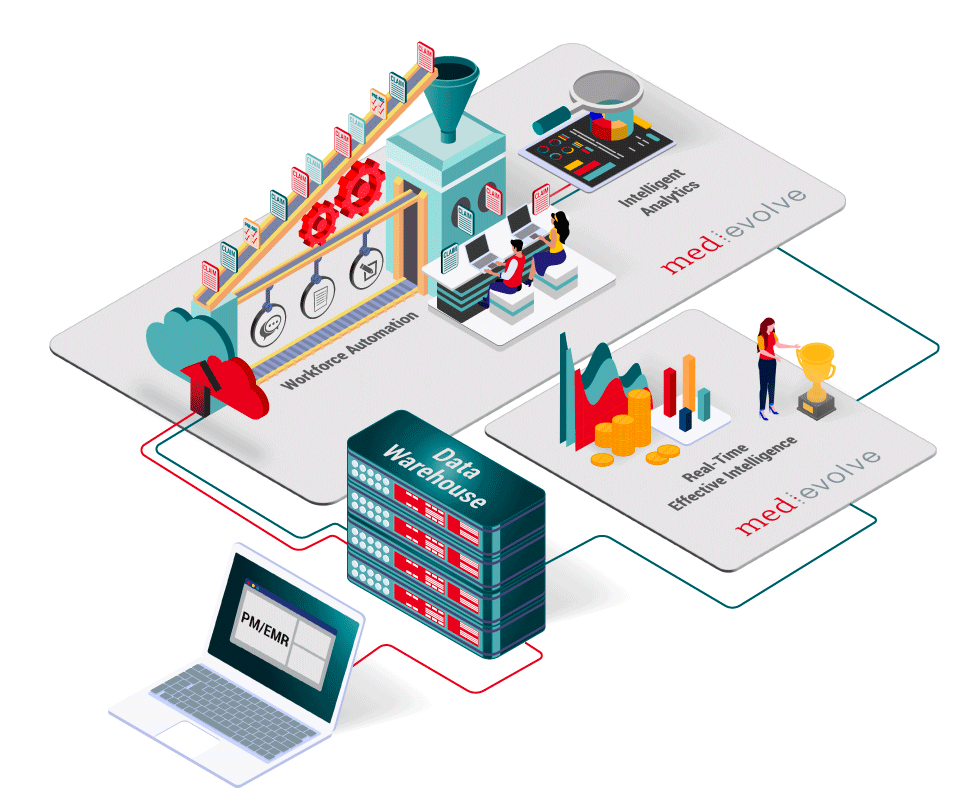

As depicted in the below image, effective intelligence is derived from data that comes from multiple sources—practice management systems, EHRs and (most importantly) workflow automation solutions. This holistic view moves a practice from basic intelligence to effective intelligence.

The importance of flawless financial clearance

The shift toward increased patient financial responsibility is not slowing. This trend continues to tilt the reimbursement scale away from insurance claims and onto the patient–and physicians are feeling the pinch: A 2021 report revealed that providers currently only collect 55% of what is owed by patients, and can take up to 3 months to collect when not captured proactively. This means, a successful revenue cycle strategy must address patient financial clearance and engagement.

While paramount to reducing back office issues, financial clearance strategies (preregistration processes that promote collection of demographic data, insurance information and patient payments prior to a patient appointment) also improve the overall patient experience. Patients feel better prepared to uphold their financial responsibility and are able to focus on their health when they arrive for their appointment with all of the mundain details out of the way.

On the back end, the ideal scenario is when a claim is processed without any manual work or human intervention, we call this zero-touch resolution rate (ZTRR). If your financial clearance processes are completed properly, claims can be fully processed and paid without a billing person touching them. The higher your ZTRR, the less manual work effort is required from your billing team, which reduces your staffing needs. The right combination of automation, mobile engagement and patient financial counseling services can minimize avoidable denials, improve collections on patient responsible balances and lead to higher patient satisfaction.