Do you know your "work effort" on a claim?

What do I mean by “chatter”? I’m talking about all the back and forth that goes between your employees and your providers to get your claims paid correctly in a timely fashion which you currently can’t measure with your PM/EMR system. They do not tie those activities to a visit. As a revenue cycle manager, you are probably managing communication on spreadsheets, emails, phone calls, voicemails, and shouting over cubicles. So you don’t know the amount of work effort or “touches” that it took to get the claim paid.

Why does work effort need to be measured?

You also can’t measure the claims that went out the door and got paid without a human touch. I don’t mean clean claim pass rate – that’s just one small factor. If you have a 97% clean claim pass rate, I would still want to know how many of your medical billing staff had to touch the claim before it got paid. You need to know that because you are paying 20% more for your staff today than you did a couple of years ago. You need to know whether they are effective or not, and make sure that you’re recognizing, rewarding, and retaining your most effective people. You have to be able to measure every touch. The biggest value beyond just centralizing all that chatter and being able to report on it, is also gaining the data points to understand breakdowns in the revenue cycle.

The value of centralizing internal communication

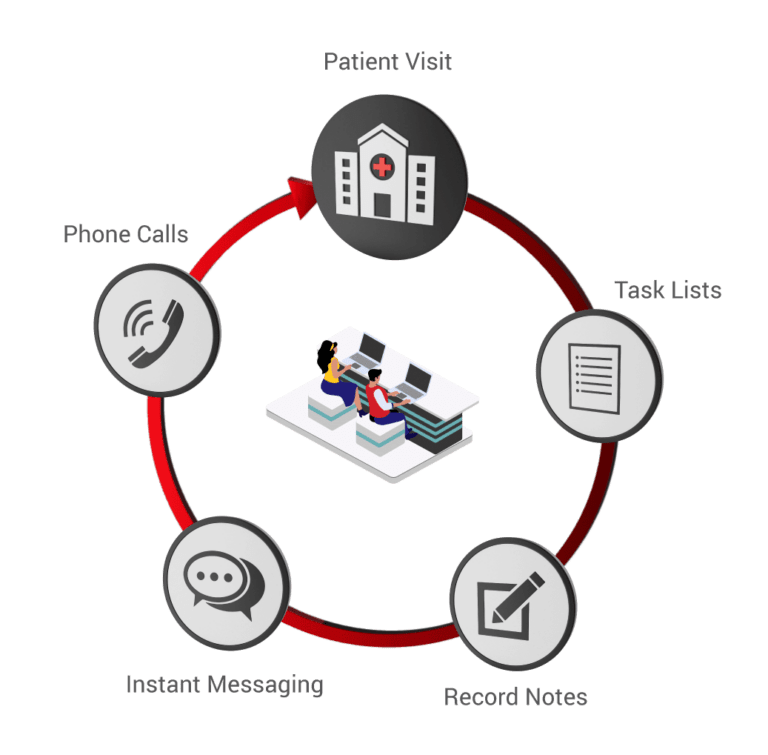

If an insurance A/R representative calls a payor finds out that a claim has been paid, but it just hasn’t been posted, then they would need to send an email/note/task to the payment posting team who then have to research why it wasn’t posted. With centralized task management and internal communication, the AR representative would not have needed to make a call and would have used the time working on claims that actually needed their attention. By measuring your engagement with payers and other departments, including your physicians, in order to reduce the amount of human touches it takes to get you paid correctly on time, you may be able to reduce FTEs, reduce overtime, and lower your labor costs. The additional benefit is a better net collection rate, since you are able to identify your breakdowns in payment and fix your process.

How many "touches" does it take to get the claim paid?

Phone calls, completed tasks, notes, & instant messaging create “touches” which help you measure work effort that is tied to a patient visit. The more work effort it takes, the higher the labor costs. In addition, your team is able to learn from past claim experiences and improve outcomes in the future.

Increased costs are crushing the margin of healthcare organizations – labor shouldn't be

Your margin is getting crushed with increased costs – supply chain, clinical and administrative labor as the top two. Payers and Medicare are not going to pay you more – they are paying you less. High deductible plans are not going away. Consumers are owing you more, but they are worried about keeping their job, paying their rent, and paying for heat. So they might pay you, but they will need a payment plan. They may just decide not to do the procedure. There are too many factors outside of your control. You need to be able to measure work effort and outcome, and that starts with upgrading your PM system with additional technology that can actually measure your people.

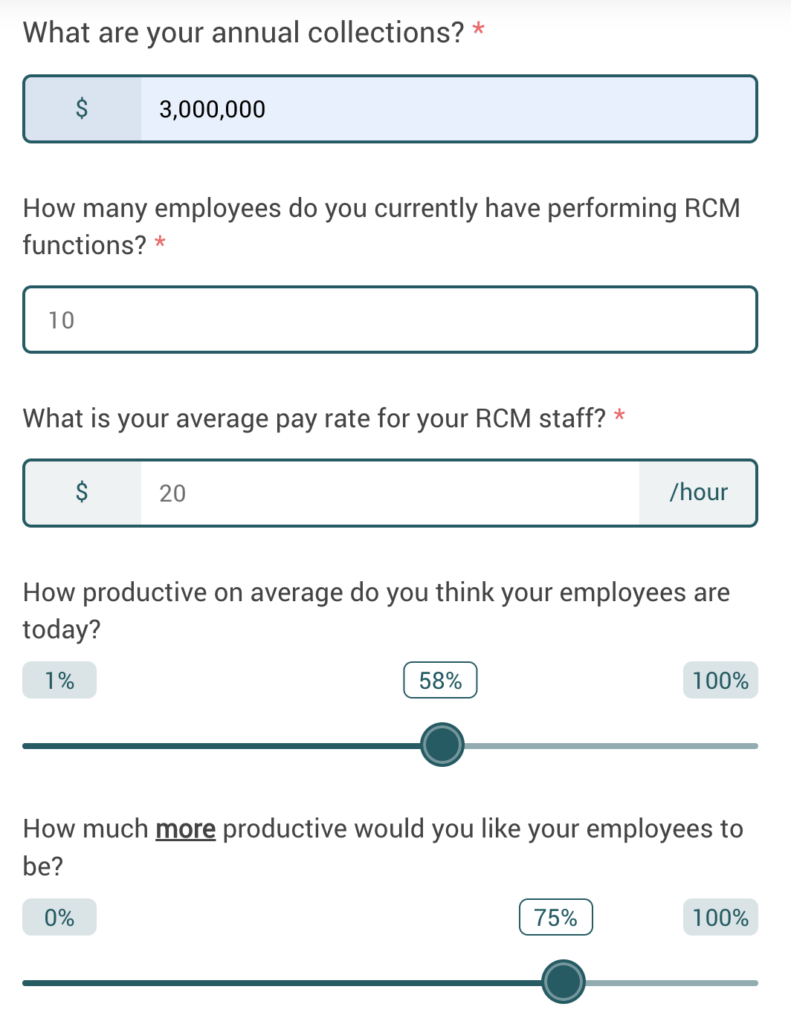

If you could increase the productivity of your RCM employees, what is your potential labor cost savings & net collection increase?

About Matt Seefeld

Matt Seefeld, Executive Vice President & Chief Commercial Officer at MedEvolve, brings over 24 years of management consulting experience in the healthcare industry. He has extensive expertise in the assessment, design and implementation of process improvement programs and technology development across the entire revenue cycle. Matt began his career with Stockamp & Associates, Inc. and worked for both PricewaterhouseCoopers LLP and Deloitte Consulting LLP in their healthcare and life sciences practice lines. In 2007, he developed a business intelligence solution and founded Interpoint Partners, LLC, where he served as Chairman and Chief Executive Officer. In 2011, he sold his business to Streamline Health Solutions where he then served as Chief Strategist of Revenue Cycle followed by Senior Vice President of Solutions Strategy until 2014. Matt ran global sales for NantHealth and provided consulting services for healthcare technology and service businesses nationwide, prior to joining MedEvolve full-time.

Matt Seefeld, Executive Vice President & Chief Commercial Officer at MedEvolve, brings over 24 years of management consulting experience in the healthcare industry. He has extensive expertise in the assessment, design and implementation of process improvement programs and technology development across the entire revenue cycle. Matt began his career with Stockamp & Associates, Inc. and worked for both PricewaterhouseCoopers LLP and Deloitte Consulting LLP in their healthcare and life sciences practice lines. In 2007, he developed a business intelligence solution and founded Interpoint Partners, LLC, where he served as Chairman and Chief Executive Officer. In 2011, he sold his business to Streamline Health Solutions where he then served as Chief Strategist of Revenue Cycle followed by Senior Vice President of Solutions Strategy until 2014. Matt ran global sales for NantHealth and provided consulting services for healthcare technology and service businesses nationwide, prior to joining MedEvolve full-time.